Financial Anxiety, Simmer Down

For this week’s blog post, I was flirting with the idea of phoning in an article and maybe writing a bit about hangover cures for the weary partier left to nurse their wounds after a night of rowdy revelry in celebration of our nation’s independence. After all, many of my July 5th’s in recent years have been dominated by increasingly severe hangovers (this getting older thing is a real drag) and so I’ve accrued some fairly useful information to share on the subject. Aspiring to ease the pain of the wounded, regardless of how self-inflicted the pain may be, is at its root a good and worthy endeavor. Certainly, there were plenty of us who could have used some well-timed advice yesterday; however, each time I sat down at my computer to begin click-clacking at my keyboard to ultimately produce this sagacious overture of how ingesting B vitamins will help with the shakes and soaking in a mustard bath will help to kick-start the detoxification process, I kept falling short of finishing my first sentence.

Since the start of this blog, I have encountered many pesky iterations of “writer’s block” and the various, and increasingly ridiculous, tasks that I invent for myself to do as a form of “productive” procrastination. I have come to know the feeling well and have become more aware of my procrastination when I am in the throws of a “High Fidelity”-esque re-categorization of my music or movie collections. When the thought “Wouldn’t it be cool if I organized my CDs based on when I bought them?” comes to mind, I have gotten better at realizing that I need to stop distracting myself with trivial tasks and just force myself to sit down and write. Yesterday felt a little different. Sure, I was feeling pretty lazy. Sure, I did seven loads of laundry instead of writing and even folded every last stretch of cotton and polyester I own. Yes, folks, I was setup for the pretty standard internal battle of trying work done instead of going out to eat or helping Batman rid the villains from Gotham once and for all, but normally I can find something that inspires me and the words will eventually come. Yesterday, though, I kept having the recurring thought “Don’t I have any better advice to offer than a couple of tired ideas about curing a hangover?” As it turns out, I do.

For as long as I can remember, which goes all the way back to the days of having a weekly allowance of $1, I have had an anxiety about money. While I have gotten loads better over the years, I will still stand in the aisles and deliberate for a long time over a $0.40 difference in laundry detergent prices. I simply can’t help myself. It should be noted, however, that I realize I am placating myself by calling it “financial anxiety,” when the vast majority of us know the affliction better as being a tight-wadded cheapskate, but nevertheless I have a hunch worrying about money is something we all can relate to. For better or for worse, money is something we have to reckon with on a daily basis. Instead of burying our heads in the sand and hoping that if we don’t think about it for too long those credit card bills just might stop showing up in the mail, why don’t try to take a little bit of control of the financial aspects of our lives and get smart about how we are spending our money? At the very least, let’s become more AWARE of how we are spending our money.

My wife and I moved to NYC from North Carolina right out of college and so my thoughts were often dominated by worrying about money, and our lack thereof, for the first couple of years. We both had worthless college degrees in the arts and had somehow thought moving to one of the most expensive cities in the country in the midst of an economic collapse with no jobs would be a gentle introduction to the world of paying your own bills. Needless to say, it was not. We had a massive rent to account for, loans from parents to repay, and interest-bearing credit card debt to hack away at whenever possible. Throw in the need to ingest food on a fairly consistent basis and the painful epiphany that the city government takes a sizeable share of your income in addition to the feds and the state and you run out of money before you even think about going to see a movie or having a modest meal out. In short, every dollar hurt to spend and it became immediately clear that I was going to need some help if I was going to meet my monthly expenses and chip away at my debt. I was struggling with understanding that the first two paychecks of every month could not be spent but must simply be handed over to the landlord. The third paycheck went to cover the phone and utilities and the fourth check would hopefully cover some food and if I ate enough ramen and wasted nothing, I could make it out to the latest Will Farrell movie with the $12 I had left over for the month.

It was within the realization that the majority of my monthly income was already “spoken for” before I even earned it that I began to understand and appreciate the real need for budgeting one’s finances. If I treated every paycheck like I used to in high school or college and went out to immediately blow it on video games and lite beer, my landlord and I would be having some difficult conversations sooner rather than later. It only takes perhaps five seconds of standing on an NYC street to know that you really, really don’t want it to be your home and so getting responsible about my inflows and outflows of cash became top priority. I started small and scribbled down notes in a spiral notebook of what I was earning and spending on a monthly basis and tallied up the meager funds that the government was nice enough to leave me to determine my monthly spending maximum. Once I knew what amount I had to work with on a monthly basis, I began to trim it down by removing the costs that wouldn’t change on a month-to-month basis like my rent and monthly train pass. Next, I looked at my utility costs and did my best to estimate the average monthly cost and set aside a portion of my income to cover that. Now that I had the roof over my head and utilities covered, I knew that I needed make a plan to chip away at my debt. I came up with a steady payment plan I could stick with and took that out of the remaining funds. That left only one essential cost left, which was food. After reviewing the leftover funds I had available after covering my expenses and debts, I portioned off the vast majority for food and then divided that into a weekly amount. The remaining pennies were slotted for miscellaneous household expenses (cleaning supplies, toiletries, pet food, etc.) and for entertainment (movies, music, etc.).

At this point, I was feeling a little disheartened that 95% of my income was set aside purely for survival but I was happy to know that I had enough to cover my expenses and had a clearer picture of what my real budget was. The self-satisfaction lasted only a few moments when I realized that I was going to have to track these expenses somehow to ensure that I was staying on budget. Most of my costs weren’t the same dollar amount each month so they’d need to be written down in some way. I used my spiral notebook for a couple of months but it was an incredibly tedious process with having to hand-write everything and then busting out a calculator to tally things up. Being a drama major in college, I didn’t have much reason to come in contact with Excel until I started working in the “real world.” Once I became more familiar with the many wondrous ways that make Excel an awesome program, I worked towards building a model that would virtually track all of my expenses for me and give me a real-time balance of what I had left available to spend for the month. Before long, I was in the groove of entering my expenses every couple of days and was starting to feel more and more relieved as my financial picture became clearer. Because I was taking a look at my spending more regularly, I was able to see how every little purchase added up and it helped me to deny the impulse to buy that bottle of water at the deli or spring for a cab when it was raining. I knew that $2 I spent on water or a coffee could add to paying for a much more enjoyable activity like having a meal at my favorite restaurant. Although I wasn’t making any more money, my relationship with my finances had improved dramatically. I worried much less and felt much more in control. When you’re not worrying about money, your mind is free to focus at work, be present with your friends when you’re hanging out and pursue your dreams and hobbies in your free time. It’s a beautiful thing.

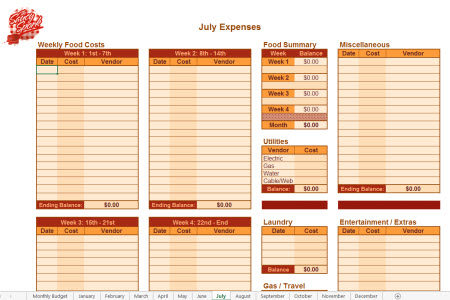

Starting to track and monitor my spending was a major shift in how I was living my life on a daily basis and a huge quality of life improvement for me. I hope that will be the same for you and so I have created a modified version of my model for you to download and use. I’ve done my best to make it relevant to the most amount of people as possible. On the model itself there are instructions on how to use it, but I hope that it is fairly straight forward. Here is a summary of key features:

- there is a main page where you can plug in your income and then portion it out into the various categories. The categories that are variable, such as food costs, are displayed in bold text in the budget section and whatever dollar amount you assign to those categories is linked to the individual worksheets for each month. You will see tabs for January through December located from left to right across the bottom of the workbook next to the “Monthly Budget” tab.

- as you enter in your expenses into the fields available on the individual month tabs, you will see the remaining balance in the given category update in real time. For example, if you can spend $100 a week on food and you buy a $10 lunch, when you input the lunch expense you will see that your remaining balance is now at $90.

- because the individual month tabs are linked to the main budget tab, if there is a change in your income, all you have to do is make changes in the budget and they will update automatically. Easy enough, right?

- most importantly, this is a tool that is supposed to help you. Please, PLEASE make whatever tweaks you’d like to the model so that it benefits you the most. The only thing that I ask is that you do not attempt to pass this model off as your own or attempt to sell it. That would be, plainly speaking, a dick move.

At first glance, you may think all of this is going to be a ton of work and it may feel that way at first. With anything, though, you get out what you put in and so the sooner you can incorporate tracking your finances into your weekly routine, the better. As a matter of practice, I charge everything I possibly can to a credit card. I do this for two reasons: 1. it’s a lot easier to keep track of and remember what you’ve spent, 2. many credit card companies have programs where you can get statement credits or travel programs once you’ve spent enough money. This is a great way to make your every day purchases work for you. There is, however, a HUGE caveat with this piece of advice: you have to pay your credit card balance off at the end of every month. Credit cards are dangerous as they allow you to live above your means. They can quickly become your worst enemy if you allow them to. Use them to your benefit, not to your undoing.

Please feel free to contact me if you have any questions about how to use the model or if you are looking for other ways to manage your finances. I feel strongly about this subject so I am more than happy to offer any help that I can. In the meantime, know that you have the power and wherewithal to be the master of your own budget and you, too, can have the peace of mind that I have in knowing exactly where you stand at any point in the month or year. Knowing is half the battle and can work to your advantage if you are brave enough to face the reality of your current situation. More times than not I’ve found that I have money leftover from the various categories that I can turn into a nice, guilt-free “treat” for myself (or if I’m feeling responsible, more over into my savings account). By using this model and tracking my expenses, I was able to wipe out thousands of dollars of debt and turn that into thousands of dollars of savings. Download the model below and take control of your finances!

After you’ve finished your homework, treat yourself to a tasty dessert! See below for the recipe.

Erin Mellas

July 8, 2015 (11:15 am)

Thank you so much for posting this. I have a excel spreadsheet that is VERY basic and similar to this that I have used for years. I was getting a little bored or it and decided that I wanted to change it up a bit. Now I don’t have to.

Love you guys and miss you terribly! You need to get out and visit to Utah.

With great love and admiration!

Your cousin… Erin